Utilising Losses with Tax Planning Services

- Daniel

- Jan 1

- 3 min read

Utilising losses with Tax Planning Services could help you maximise some of the tax reliefs for your business, if you have a limited company and you have accrued some trading losses, there are different methods available to use those trading losses and reduce tax payments.

Carry forward loss relief

The loss is carried forward to future accounting periods and is offset against future total profits but before qualifying charitable donations (QCDs).

Example:

Suppose you carry forward a trading loss of £1,000,000 from last year, and you have paid £500,000 in QCDs:

The current year taxable total profits is reduced by £1,000,000, hence paying less tax.

With the Carry Forward Loss relief facility, the total trading loss to be relived in the future can be restricted so you only use what you need/want. The loss can be carried forward indefinitely and there is no need to make a current year or a prior year claim first.

Unused losses will be carried forward to the following accounting period as long as the trade continues.

Current year loss relief

If a current year loss relief claim is made, trading losses are set off against Total Profits (property income, chargeable gains, non-trading loan relationship income) before deduction of QCDs of the same accounting period. Therefore, you get tax relief by offsetting the trading loss against your other gains or profits of your business in the same accounting period.

A current year claim must be made for the whole trading loss; a partial claim is not allowed.

It should be claimed within two years of the end of the loss making accounting period.

As the loss is set off before the deduction of QCDs, the QCDs in excess (i.e. not used) will be lost if there are insufficient profits after the loss relief. Also note that a current period claim has no restriction in the amount of loss to be set off.

Example of how to utilise losses with current year loss relief with Tax Planning Services:

Suppose you have a trading loss of £3,000,000 in current year. You also have Property Income of £1,000,000; Chargeable Gains of £1,500,000 and Non-Trading Loan Relationship Income £500,000; and you donated £500,000 which are qualifying. You set off the trading loss as follows:

Carry back loss relief

Any trading loss remaining after a current year claim (above) can be carried back to previous 12 months. Note that you first need to set off against total profit of the current year (current year claim) before claiming back against previous year total profits. Therefore it is the unused balance from the current year that can be carried back against previous year total profit.

Under carry back loss relief, trading losses are set off against total profits (before deduction of QCDs) of the previous 12 months on a LIFO (last in first out) basis.

A carry back claim can only be made if a claim for current year loss relief has been made first. The carry back claim is optional and must be made within two years of the end of the loss making accounting period.

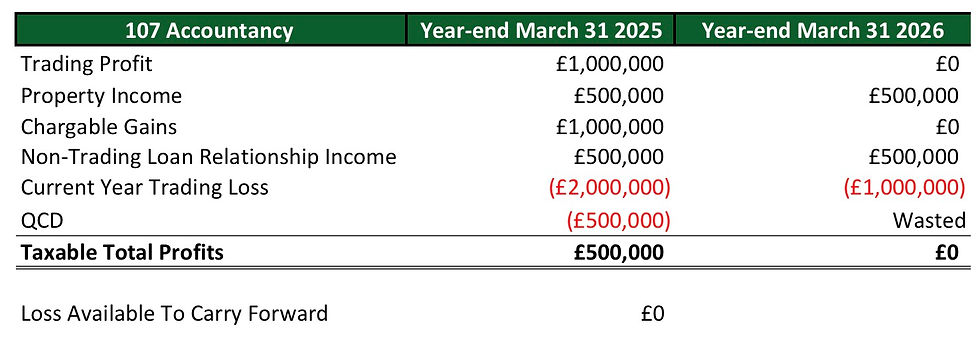

Example of how to utilise losses with carry back loss relief with Tax Planning Services:

Suppose you have a trading loss of £3,000,000 in current year. You also have Property Income of £500,000 and Non-Trading Loan Relationship Income £500,000 and you donated £500,000 which are qualifying.

Last year your Trading Income was £1,000,000, Property Income £500,000, Chargeable Gains £1,000,000, Non-Trading Loan Relationship Income £500,000 and your Qualifying Charitable Donations were £500,000.

You make a claim first to current year and then to previous year to set off trading losses of £3,000,000 against total profits. You set off the trading loss as follows:

Capital losses

A capital loss incurred in an accounting period is relieved against any chargeable gains arising in the same accounting period. Any excess losses are then carried forward for relief against gains arising in future accounting periods.

Relief is automatic – no claim is required. A capital loss may never be carried back and relieved against chargeable gains for earlier periods.

Capital losses can only be set against gains, they may not be set against the company's income.

Partial claims are not allowed.